We often discuss about the cost accounting and we will end up with the various questions in our head without

answer or answers to very few questions. So today I decided to answer one such

question that’s “What are the Elements of Cost”. Today in this article

we will learn and will try to understand the elements of cost.

ELEMENTS OF COST

|

| Elements of Cost |

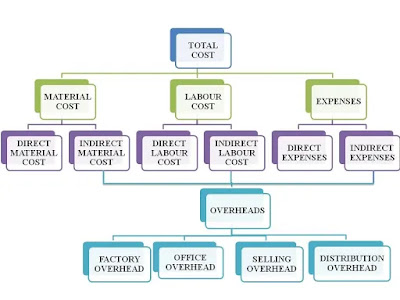

From the above chart of elements of

cost total cost can be divided mainly into Material cost, Labor cost and

Expenses. Further Material cost can be divided into direct material cost and

indirect material cost, Labor cost can be divided into direct labor cost and

indirect labor cost and Expenses into direct expenses and indirect expenses.

Now let’s discuss each one of the cost

and try to understand it below.

§ Total Cost:

Total cost

refers to the cost of production by adding up all the expenses to produce a

product or purchase an investment or acquisition of plant and machinery. Total

cost is mainly classified into material cost, Labor cost and Expenses.

§ Material Cost:

Material Cost

refers to cost incurred in procurement of the raw material, consumable stores

and so on. The material cost is further divided into two types of material cost

namely direct material cost and indirect material cost.

·

Direct

Material Cost :

Direct Material

cost refers to cost of material which can be identified in the final product

produced. For instance, wood used in furniture.

·

Indirect

Material Cost:

Indirect

Material cost refers to material cost which can be identified in the final

product produced but cannot be directly related to the product produced. For

Instance, Nails and threads used in preparing shoe.

§ Labor Cost:

Labor cost

refers to the remuneration paid to labor such as wages, salaries, commission

and so on. The labor cost can be further divided into direct labor cost and

indirect labor cost.

·

Direct

Labor Cost:

Direct labor

Cost refers to the remuneration paid to the labors who are involved directly in

the production activities.

·

Indirect

Labor Cost:

Indirect Labor

cost refers to the remuneration paid to the workers who are not directly

involved in the production activities. For instance, wages paid to office

workers.

§ Expenses:

Expenses refer

to the cost incurred during production other than material and labor cost by a

business. Expenses are further divided into direct and indirect expenses.

·

Direct

Expenses:

Direct Expenses

refers to the cost which incurred directly and can be easily identified by the

cost centre or cost unit. For Instance, Production Expenses

·

Indirect

Expenses:

Indirect Expenses as known as fixed

expenses. Indirect or fixed expenses refer to those expenses that don’t vary

with respect to the quantity produced.

Now

let us see some of the examples for the above elements of cost below in the chart.

|

Particulars

|

Elements of Cost

|

|

Wages paid to

sweepers, wages paid to maintenance workers, Nails used in Shoe, Oils used

for lubricating machines, Factory Stationary, Directors fees (Factory),

Unproductive Wages, Estimation Expenses, Water Supply, Haulage, Experimental

Expenses, Sale of Scrap, Convertible Materials, Welfare Expenses and more.

|

Factory

Overhead

|

|

Salesman

Commission, Agent Commission, Warehouse Salary, Discount on Sales, Bad debts,

Travelling Expenses, Depreciation on Delivery Van, Upkeep of Delivery Van,

Material used in selling a product and more.

|

Selling and

Distribution Overhead

|

|

Paper used

for printing paper, Bags used for Packaging, Material used in Packaging and

more.

|

Direct

Material Cost

|

|

Wages paid to

piece workers and more.

|

Direct Labor

Cost

|

|

Bank Charges,

General Expenses, Legal Expenses, Counting house salaries, Establishment

Expenses, Royalty, Branch office Expenses and more.

|

Office

Overhead

|

|

Special

design, Carriage on Material, Chargeable Expenses, Exercise Duty and more.

|

Direct

Expenses

|

Comments

Post a Comment