In this article let us try to understand what are the different types of accounts and also the three golden rules of accounts in this article.

Types of Accounts

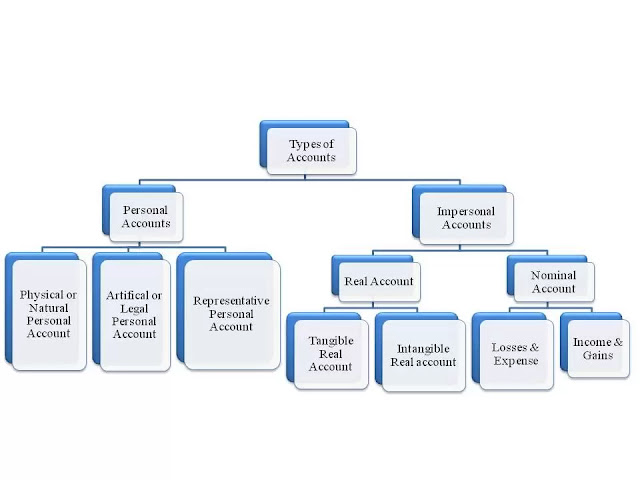

Accounts are classified two types

mainly. They are personal account and Impersonal Account. Accounts are mainly classified into Personal A/c, Real A/c & Nominal A/c.

§ Personal Accounts:

These are those accounts of

person with whom a concern carries on business which includes Persons,

Institutions etc

· Physical or Natural Personal Account:

These

are the accounts which are being held by human being or individual.

For instance, Ramesh, Suresh, Raju etc

· Artifical or Legal Personal Account:

These

are the accounts belonging to artificially created person by law such as firms,

companies, clubs, associations, banks, schools, colleges etc.

For instance

TATA, HAL ,SBI etc

· Representative Personal Account:

These are the personal accounts which belong

to amount to be received or amount to be received in advance or O/s expenses.

§ Real Account:

These are the accounts which belong to asset, properties owned by

business or firm.

· Tangible Real Account:

The

assets which can be touched such as building, land, furniture etc

· Non-Tangible Real Account:

These

are the assets which can't be touch but can be feel such Goodwill, Copyright,

Patent and so on.

§ Nominal Account:

These are the accounts which exists in only in name and they cannot

be seen or touch. This includes all expenses and loss and incomes and gains.

For instance, Commission Earned, Discount Received, Rent Paid and so on.

Golden Rules of Accounting

These are the fundamental rules used to post a transaction. It is

also known as “Rules for debit and credit”

§ Personal Account:

Debit the Receiver

Credit the Giver

§ Real Account:

Debit what comes in

Credit what goes out

§ Nominal Account:

Debit all expenses and lossesCredit all incomes and gains

§ Debit : Debit represent increase in value of asset and expense but decrease in the income, liability and equity.

§ Credit: Credit represents increase in liability, equity and income but

decrease in asset and income.

Comments

Post a Comment