In today’s article let me try to make

you understand what is factoring? Explain Different types of factoring?

Introduction to Factoring

The word “Factor” is derived from Latin

word “Facere” which means to make or to do or get things done. Factoring first

came into existence in the year 1920.In initial period factoring is neither

regarded as organized sector nor Association of British Factors. Today the

factoring business is spread out in 60 countries covering more than 100,000 businesses

with a factoring volume of USD 700 billion in a year. 90% of the factoring

turnover comes from USA and European countries. In 1988 RBI appointed a

committee called C.S. Kalyanasundaram Committee which suggested to start

factoring by bank through its subsidiary.

Definition of Factoring

According to Peter M Biscose factoring

can be defined as A continuous relationship between financial institution (a

factor) and a business concern selling goods and/or services (the client) to a

trade customer on an open account basis whereby the factor purchases the

clients book debts (account receivables) with or without recourse to the client

– there by controlling the credit extended to the customer and also

understanding the sales ledgers relevant to the transaction.

Meaning of Factoring

Factoring is an agreement between

seller and a financial institution where by financial institution purchases the

receivables of the customer and also controls and administers the receivables.

In Simple words Factoring agency takes the risk of collecting the receivables

from the respective parties and bears the risk of non-payment of debt and

losses. The specialized activity of factoring firm is to convert the

receivables into Cash.

Factoring is a financial service

covering die financing and collection of receivables both in domestic and

international market.

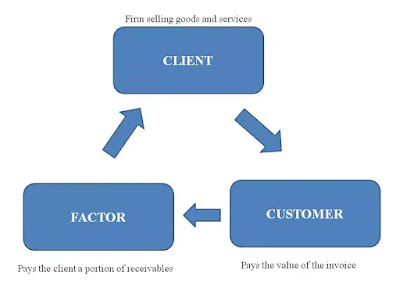

Parties Involves in Factoring

There are three parties involved in factoring. They are

§ Seller(Client)

§ Customer and

§ Factor

Seller

Client

is the person or firm who wants to sell goods or services to customers.

Customer

Customer is the person or firm who

wants to buy the goods and services of client but doesn’t have sufficient funds

to buy them so purchases them on credit.

Factor

Factor is a financial institution

which enters into agreement with client to provide factoring services. The

factor receives the payment from the customer on due date and deducts the

agreed amount and makes the payment to client.

Types of Factoring

Various types of factoring services are as follows,

§ Recourse and Non-Recourse Factoring

In recourse

factoring the receivables purchased if turns out to be bad, then the risk is

completely beared by the client and the factoring agency doesn’t assumes the

credit risk associated with it.

While in

non-recourse factoring the factor bears the complete risk or loss occurred on

the non-payment of the customer and the factor cannot claim the amount from

selling firm or organization.

§ Advance and Maturity Factoring

In advance

factoring the factoring agency pays a fixed percentage amount of the

receivables (usually up to 75%-90%) and up to guaranteed payment of the amount

from customer the rest of the balance amount will paid to the client.

In maturity

factoring no advance is paid to client only on the collection of receivables an

agreed amount is paid to the client. Maturity factoring consists of sale of

account receivables to factor which doesn’t make any advances at the time of

sale.

§ Conventional or Full Factoring

This factoring

is also known as Old Line Factoring. In this factoring the factoring agency

performs almost all the services of the factoring such as collection of

receivables, maintenance of sales ledger, credit control and credit insurance.

The factoring agency sets a limit based on bills outstanding maturity wise and

takes up the corresponding risk of default or credit risk and the factor will

claim the debtor as also the client credit.

§ Domestic and Export Factoring

In domestic

factoring three parties involved resides in the same country. The parties are client,

factor and customer.

In Export Factoring

the parties involved are Exporter (client), importer or customer and export

factor and import factor. This kind of factoring is called Two-factor system of

factoring. In two-factor system results in contract between

·

Exporter(client)

and export factor

·

Export

factor and Import factor

§ Limited Factoring

In Limited

factoring the factoring agency discounts only specific invoices on selective

basis and converts credit bills into cash with respect to selected bills only.

§ Selected Seller based Factoring

Under selected

seller based factoring the seller sells all the account receivables to the

factor along with the delivery challans, contracts etc after invoicing to the

customers. The factoring agency performs all the accounts, collection of debts,

sending reminders and does all the consequential and incidental functions of

the seller. The seller is normally approved by the factor before entering into

the factoring agreement.

§ Selected Buyer based Factoring

Under selected

buyer based factoring the factoring agency first selects buyers based on

creditworthiness and goodwill and prepares an approved list of them. The buyers

of the company approach the factoring agency for discounting their purchases

receivables drawn in favor of company by seller. Then the factor discounts the

bill without recourse and makes the payment to the seller.

§ Disclosed and Undisclosed Factoring

In disclosed factoring

the name of the factoring agency is mentioned in the invoice by the supplier

asking the buyer to make payment to factor on the due date. However supplier

can bear the risk of bad debts without passing to factor.

In the undisclosed factoring the

name of the factor is not mentioned yet the control lies with the factor.

Comments

Post a Comment